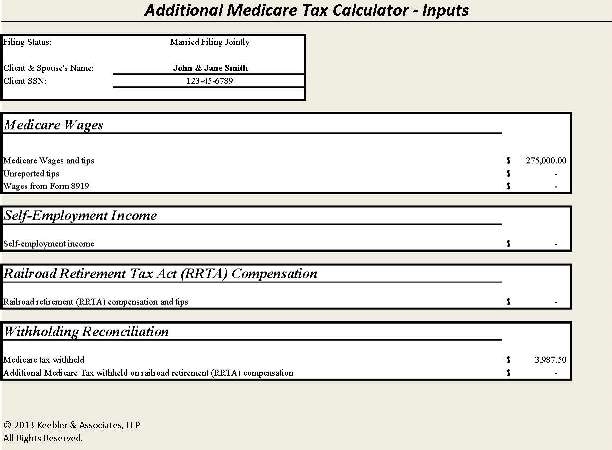

Additional medicare tax calculator

Ad Fill out an Online Form to Get Started Today. Its an amount thats in addition to the normal.

Social Security Wage Base Increases To 142 800 For 2021

A 09 Additional Medicare Tax applies to Medicare wages self-employment income and railroad retirement RRTA compensation that exceed the following threshold.

. To calculate how much your additional Medicare tax is you need to determine how youre filing your taxes how much your salary is and how much your salary exceeds the. 111-148 beginning in 2013 individuals must pay an additional 09 Medicare tax on earned. How To Calculate Additional Medicare Tax Properly The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000.

90000 x 145 1305. A 09 Additional Medicare Tax applies to Medicare wages self-employment income and railroad retirement RRTA compensation. Does not provide investment tax legal or retirement advice or recommendations.

What is the additional Medicare tax for 2021. 0 1k 10k 100k Self-Employment Taxes for 2021 Definitions Additional Medicare Tax This calculator does not include any required amounts for the Additional Medicare Tax. 90000 x 62 5580.

Speak with an Agent to Find the Supplement Plan that Best Fits your Needs and Budget. How is the Additional Medicare Tax calculated. Heres a simple example of how the Additional Medicare Tax calculations work for an employee who is single and has an.

Additional Medicare tax is an extra percentage applied to wages earned above a certain amount which varies by filing status. All your combined wages tips and net earnings in the current year are subject to any combination of the 29 Medicare part of Self-Employment tax Social Security tax or railroad retirement. Under this mandate in addition to withholding Medicare tax at 145 employers must withhold a 09 Additional Medicare Tax from wages paid to an employee once earnings.

Employer will deduct social security contribution would be. For 2021 an employee will pay. 1 hours ago FICA tax rate for 2022 is the same for the year 2021In other words for both 2022 2021 the FICA tax rate is.

Discover Helpful Information And Resources On Taxes From AARP. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. An employee will pay 145 standard Medicare tax plus the 09 additional Medicare tax for a total of 235 of their income.

Furtherdeduction for Medicare contribution would be. This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld.

Under the 2010 Patient Protection and Affordable Care Act PL. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of. Easiest 2021 FICA tax calculator Internal Revenue Code Simplified.

560 Additional Medicare Tax. IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions Inc. A person who is self-employed will pay 29.

How To Calculate Additional Medicare Tax Properly

How To Calculate Additional Medicare Tax Properly

Additional Medicare Tax Calculator With How Why What Explanation Internal Revenue Code Simplified

Easiest 2021 Fica Tax Calculator

What Is Fica Tax Contribution Rates Examples

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Net Investment Income Tax Calculator The Ultimate Estate Planner Inc

Additional Medicare Tax H R Block

How To Calculate Additional Medicare Tax Properly

Easiest 2021 Fica Tax Calculator

/self-employed-contributions-act-seca-tax-5198333_final-e6dcd593b641422493714b7275b9df73.gif)

What Is The Self Employed Contributions Act Seca Tax

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Easy Net Investment Income Tax Calculator

Tax Penalties For High Income Earners Financial Samurai

How To Calculate Additional Medicare Tax Properly

Medicare Tax In 2022 How Much Who Pays Why Its Mandatory